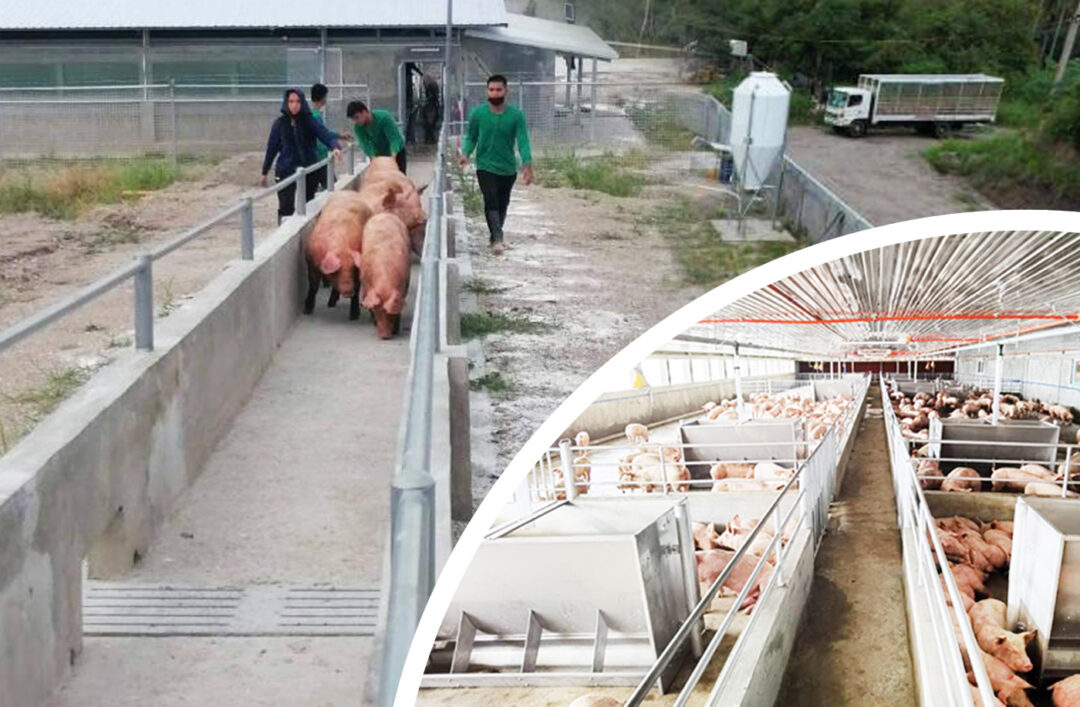

The Swine Repopulation, Rehabilitation and Recovery Credit Program – ACPC Funded (Swine R3 – ACPC Funded) is a credit window that supports the national government’s efforts in the recovery and repopulation of the local swine industry through financing of bio-secured small-scale farm projects that will contribute to ensuring the availability of pork and pork products in the market.

Eligible Borrowers

Small enterprises, including start-up commercial hog raisers duly registered with the Securities and Exchange Commission (SEC), the Department of Trade and Industry (DTI), or the Cooperative Development Authority (CDA)

Eligibility Loan Purpose

To finance the establishment of bio-secured swine wean to finish farm or consolidated swine facility covered by contract growing agreement with a DBP-Partner Integrator, including acquisition of machineries and equipment

Eligibility Criteria

The borrower must meet the following:

- Duly registered with the SEC, DTI, or CDA;

- With approved swine contract growing agreement with the DBP-Partner Integrator;

- No adverse unresolved findings in relation to Credit Investigation (CI) and Watchlist Validation (specifically charges of unlawful activities); and

- Financial ratios:

- Debt Service Cover of at least 1x

- Debt to Equity Ratio of 80:20

- For existing swine business, financial ratios should be based on the last three (3) years of operations.

- For start-up, financial ratios should be based on the financial projections of the proposed swine project subject to financing.

Credit Facility

Term Loan

Loanable Amount

Up to 90% of the Total Project Cost (TPC) with minimum loanable amount of Php 5.00 Million but not to exceed Php 25.00 Million.

Loan Tenor

Up to ten (10) years, inclusive of up to two (2) years grace period

Repayment Terms

Payable semi-annually.

Other repayment terms may be proposed by the lending units subject to justification

Interest Rate

Two percent (2%) per annum. GRT for the account of the borrower.

Service Fee

One-time service fee of 3.50%, computed based on the approved loan amount, payable upfront or to be deducted from the initial loan release. GRT for the account of the borrower

Loan Securities/Collaterals

Any or combination of the following, as applicable/case-to-case basis:

1. SAFIA in the amount equivalent to at least one hundred fifty percent (150%) of the loan or one hundred percent (100%) of receivables arising from the agreement with the DBP-Partner Integrator

2. Applicable Insurance Coverage endorsed in favor of DBP

3. Other security arrangements acceptable to DBP

Documentary Requirements

The borrower shall submit the following:

1. DBP Agricultural & Fisheries Enterprise Loan Application Form and other Bank Forms;

2. Certified True Copy of Certificate of Registration from SEC/DTI/CDA;

3. Bio-data of incumbent officers and Board of Directors with government-issued ID, as applicable;

4. Board Resolution authorizing the organization to borrow and designating authorized signatories, as applicable;

5. Audited Financial Statement and latest interim financial statement, as applicable;

6. Current year Business Permit;

7. Certified True Copy of Articles of Incorporation/Cooperation and By-Laws, as applicable;

8. Latest General Information Sheet and/or additional documents to fully establish beneficial owners of the legal entity, as applicable; and

9. Endorsement Letter/Commitment Letter/Notice of Approval/Contract Growing Agreement from Integrator

Requirements on the Project Site

The following shall be required, as applicable:

- 1. If project site is with clean title and under the name of the borrower:

Pre-Release Requirements:

i. Unregistered Real Estate Mortgage

ii. Updated Real Property Tax Payment

iii. Tax Declaration

- 2. If project site only has Deed of Absolute Sale under the name of the borrower:

Pre-Release Requirements:

i. Deed of Undertaking to submit the Transfer Certificate of Title (TCT) in the name of the borrower

ii. Copy of the TCT in the name of the previous owner

iii. Deed of Absolute Sale

iv. Updated Real Property Tax Payment

v. Tax Declaration

vi. Proof of Filing of Certificate Authorizing Registration (CAR)

vii. Electronic Primary Entry Book (EPEB) evidencing transfer of TCT to the name of the borrower

Post-Release Requirements:

i. Owner’s duplicate copy of the TCT in the name of the borrower

ii. Unregistered Real Estate Mortgage

iii. Tax Declaration in the name of the borrower

- 3. If the project site is subject to a lease agreement:

Pre-Release Requirements:

i. Lease Agreement (Lease term shall cover the loan tenor/ duration of the loan)

ii. Proof of ownership of the lessor e.g., title, deed of absolute sale, tax declaration, real estate tax receipt

iii. Assignment of Leasehold Rights

- 4. If project site is owned by a third party the Unregistered Third-Party Real Estate Mortgage shall be submitted as pre-release requirement.

Contact Details

For more information, please contact:

Program Development and Management II Department

Tel No.: (02) 8818 – 9511 local 2330/2329/2349

Email: pdm2@dbp.ph / pdm2-lpdu@dbp.ph

Please note that submission of additional documents may be required, depending on the evaluation of the Lending Center.