Unit Investment Trust Fund UITFs

Unlad Panimula Multiclass Money Market Fund

Launched on June 14, 2016, the Unlad Panimula UITF allows its investors to access rates higher than regular term deposits. It is open to all individual and institutional investors.

- Investment Outlets – Class I, II, III: Deposit Products of Accredited Banks

- Minimum Holding Period – Class I, II, III: None

- Minimum Participation – Class I: P1M; Class II: P100K; Class III: P10K

- Minimum Additional Participation – Class I: P100K; Class II: P10K: Class III: P1K

- Trust Fee (p.a.) – Class I: 0.15%; Class II: 0.25%; Class III: 0.30%

- Declaration of Trust-Unlad Panimula Multiclass Money Market Fund

- Audited Financial Statements

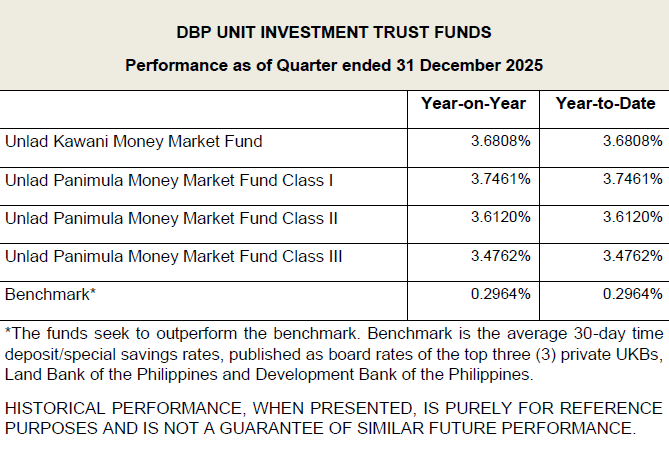

- Key Information and Investment Disclosure Statement (KIIDS) / Fund Performance Sheet (For the period ending December 31, 2025)

Unlad Kawani Money Market Fund

Launched on September 12, 2014, the Unlad Kawani UITF is open to government employees (thru the HR department of the government agency). Minimum initial participation and maintaining balance is P25. The fund allows investors to access rates higher than regular term deposits.

-

-

- Declaration of Trust-Unlad Kawani Money Market Fund

- Key Information and Investment Disclosure Statement (KIIDS)/Fund Performance Sheet (For the period ending December 31, 2025)

- Audited Financial Statements

- Historical Net Asset Value per Unit (NAVPu)

https://www.uitf.com.ph/daily_navpu_details.php?fund_id=239&bank_id=26 - Return on Investment – Year-on-Year (YOY) and Year-to-Date (YTD

- Certified UITF Salespersons

The Bank’s Certified UITF Salespersons (authorized UITF Marketing Personnel) may be verified by sending an email to tmd@dbp.ph.

-

Personal Management Trust (PMT)

The PMT is a living trust which enables trustors to manage, hold and distribute their assets for the benefit of designated beneficiaries. Initial contribution and maintaining balance is P10M. Investment outlets include deposit products, government securities and investment grade bonds.

Investment Management Account (IMA)

An IMA provides clients with portfolios that are tailor-fitted to their liquidity and growth needs. For a minimum of P5Mn, clients gain access to financial markets thru DBP Trust Banking Group (DBP-TBG) as investment manager. Investment outlets for IMA include deposit products of accredited banks, government securities and investment grade bonds.

Escrow

Assets can be held by TBG on behalf of at least two other parties that are in the process of completing a transaction.

The BIR Escrow is for individuals who intend to avail of exemption from the payment of the six percent (6%) capital gains tax on the sale, exchange or disposition of principal residence, provided that the taxpayer utilize the proceeds of the sale of former principal residence within eighteen (18) months in the acquisition / construction of a new principal residence.

Interested parties may contact:

Maria Felicia S. Magtibay

Tel No: 8818-9511 local 3408

Email: mfsmagtibay@dbp.ph / tmd@dbp.ph

Annie D. Del Mundo

Telephone Number: 8818-9511 local 6409

Email: addelmundo@dbp.ph / tmd@dbp.ph

For UITF-related queries and concerns, kindly contact:

Tel. No.: 8818-9511 local 6400

Email: dbpunladkawani@dbp.ph/ dbpunladpanimula@dbp.ph

*Trust and other fiduciary business do not provide guaranteed rate of return and are not insured by the Philippine Deposit Insurance Corporation (PDIC). Principal and earning from investment in UITFs when redeemed may be worth more or less than the initial investment / contribution. Historical performance, when presented, is purely for reference purposes and is not a guarantee of similar result. Any loss or income is for the account of the Trustor. The Trustee is not liable for losses except upon gross negligence, fraud or bad faith.

Would you like to inquire further about these products and services? Call Customer Service at (02) 683-8324 or Email: customerservice@dbp.ph