Trust

A. Unit Investment Trust Fund

Launched in June 14, 2016, the Unlad Panimula UITF allows its investors to access rates higher than regular term deposits. It is open to all individual and institutional investors.

-

- Investment Outlets – Class I, II, III: Deposit Products of Accredited Banks

- Minimum Holding Period – Class I, II, III: None

- Minimum Participation – Class I: P1M; Class II: P100K; Class III: P10K

- Minimum Additional Participation – Class I: P100K; Class II: P10K: Class III: P1K

- Trust Fee (p.a.) – Class I: 0.15%; Class II: 0.25%; Class III: 0.30%

- Declaration of Trust-Unlad Panimula Multiclass Money Market Fund https://www.dbp.ph/wp-content/uploads/2023/11/Declaration-of-Trust-Unlad-Panimula-Multiclass-Money-Market-Fund-1.pdf

- Key Information and Investment Disclosure Statement (KIIDS) / Fund Performance Sheet (For the period ending December 31, 2025)

-

- Audited Financial Statements

- Historical Net Asset Value per Unit (NAVPu)

- Unlad Panimula Multi Class I Money Market Fund https://www.uitf.com.ph/daily_navpu_details.php?fund_id=276&bank_id=26

- Unlad Panimula Multi Class II Money Market Fund https://www.uitf.com.ph/daily_navpu_details.php?fund_id=277&bank_id=26

- Unlad Panimula Multi Class III Money Market Fund https://www.uitf.com.ph/daily_navpu_details.php?fund_id=278&bank_id=26

-

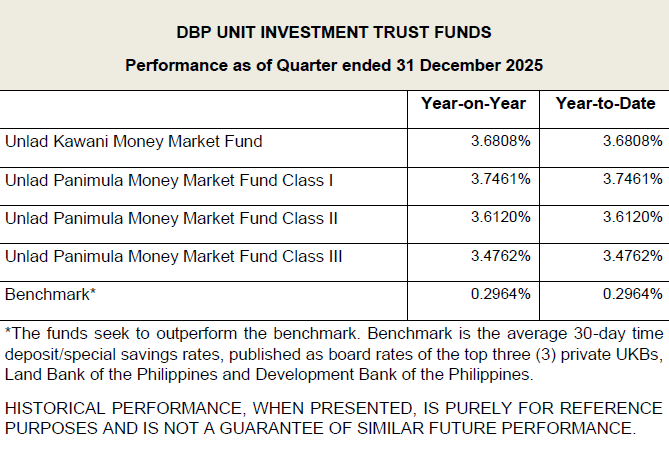

- Return on Investment – Year-on-Year (YOY) and Year-to-Date (YTD)

- https://www.uitf.com.ph/daily_navpu.php?bank_id=26

- UITF Benchmark Information

- Certified UITF Salespersons

The Bank’s Certified UITF Salespersons (authorized UITF Marketing Personnel) may be verified by sending an email to tmd@dbp.ph.

- Return on Investment – Year-on-Year (YOY) and Year-to-Date (YTD)

B. Employee Benefit

TBG can manage and administer the retirement fund of institutional clients to maximize its earnings for the benefit of the qualified employees.

C. Investment Management Account (IMA)

An IMA provides clients with portfolios that are tailor-fitted to their liquidity and growth needs. For a minimum of P5Mn, clients gain access to financial markets thru DBP Trust Banking Group (DBP-TBG) as investment manager. Investment outlets for IMA include deposit products of accredited banks, government securities and investment grade bonds.

D. Escrow

TBG can hold assets on behalf of at least two other parties that are in the process of completing a transaction.

E. Special Purpose Trust

TBG can act as SPT in monetizing regular cash flow streams (ex. real estate loan receivables) for early recovery through securitization.

F. Safekeeping

TBG can provide security for documents (ex. TCTs, securities, titles, etc.) through safekeeping and regular inventory.

Other Fiduciary Services

A. Mortgage/Collateral Trust Indenture

For corporate loans secured by a direct lien on fixed assets, TBG can ensure that the borrowing corporation is complying with collateral requirements by performing collateral checking, monitoring and reporting. It can also handle the processing of payment of taxes, insurance premiums and other expenses.

B. Facility/Loan Agency

In syndicated loans, TBG can act as an intermediary between the Borrower and the Creditors to ensure compliance by all parties with all covenants under the relevant Agreement. This service assures the Creditors that their interests are looked after and provides convenience to the Borrower by centralizing transactions with the Agent.

C. Court Trusts

TBG can serve as a court-appointed Administrator, Executor or Guardian.

D. Legislated and Quasi-judicial Trust – Credit Surety Funds

For loans obtained by MSMEs, TBG can manage the funds contributed by cooperatives, NGOs and LGUs to serve as security for the loans.

E. Directors’ and Officers’ Liability Fund (DOLF)

A DOLF is a trust fund intended to indemnify the directors and officers of GOCCs, GFIs, agency or commission against the cost of litigation and liability in the course of performing their fiduciary duties and obligations.

Interested parties may contact:

Maria Felicia S. Magtibay

Tel No: 8818-9511 local 3408

Email: mfsmagtibay@dbp.ph / tmd@dbp.ph

Annie D. Del Mundo

Telephone Number: 8818-9511 local 6409

Email: addelmundo@dbp.ph / tmd@dbp.ph

For UITF-related queries and concerns, kindly contact:

Tel. No.: 8818-9511 local 6400

Email: dbpunladkawani@dbp.ph/ dbpunladpanimula@dbp.ph

Would you like to inquire further about these products and services? Call Customer Service at (02) 683-8324 or Email: customerservice@dbp.ph